On December 2, 2025, OpenAI issued a “code red” directive. Every resource would focus on improving ChatGPT’s core functionality. Advertising implementation? Delayed indefinitely.

Six weeks later, the company announced it would begin testing ads in ChatGPT.

This isn’t a strategic pivot. It’s a financial alarm bell that tells you everything about where the AI industry is heading.

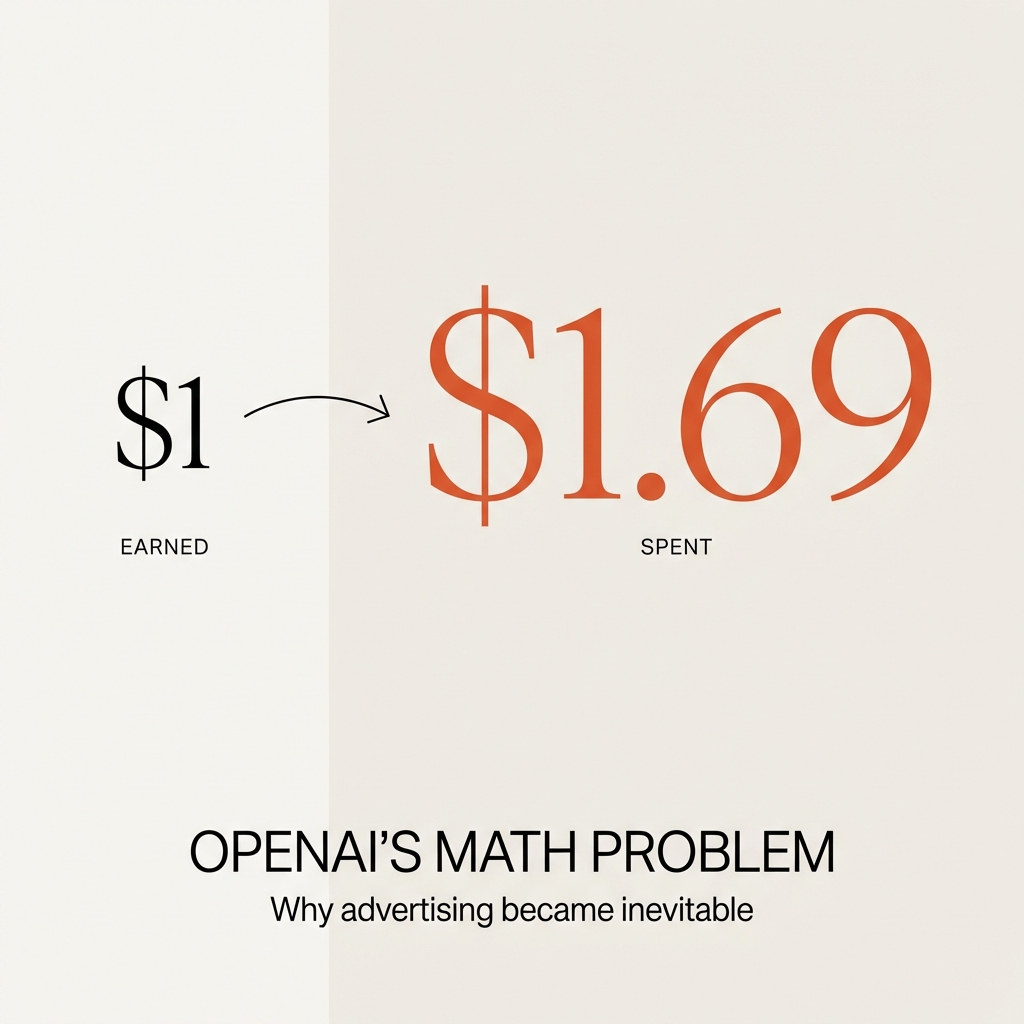

The Math That Makes Advertising Inevitable

OpenAI is burning through approximately $9 billion in the first half of 2026 against revenues of $4.3 billion. That’s $1.69 spent for every dollar earned.

The company has committed to $1.4 trillion in infrastructure spending over the next eight years while currently generating only $13 billion in annual revenue.

You don’t need an MBA to see the problem.

Here’s what makes this particularly revealing: ChatGPT has 800 million weekly active users. Impressive, right? Only 20 million are paying subscribers. That’s a conversion rate under 3%.

95% of ChatGPT users access the service for free.

Internal OpenAI documents project that “free user monetization” will generate $1 billion in 2026, scaling to nearly $25 billion by 2029. Those numbers explain why CEO Sam Altman went from calling ads a “last resort” in 2024 to fully embracing them as part of the company’s revenue strategy by January 2026.

The philosophical flip happened because the spreadsheet demanded it.

What This Tells You About AI Infrastructure Costs

Each gigawatt of AI-optimized data center capacity costs between $3-5 billion to build and operate annually. OpenAI has locked in deals for more than 26 gigawatts of computing capacity.

Do that math. Infrastructure costs alone will dwarf OpenAI’s current revenue for years.

This is why subscription models can’t carry the weight. You can charge $20 per month to 20 million people and still come up billions short when your infrastructure bill looks like a small nation’s GDP.

The advertising shift isn’t about greed or selling out. It’s about basic survival economics in an industry where the cost of doing business keeps multiplying faster than revenue can scale.

The Competitive Pressure Nobody Talks About

EMarketer projects that AI-driven search ad spending in the United States will surge from approximately $1.1 billion in 2025 to $26 billion by 2029. That’s a 23-fold increase in four years.

Google reportedly told advertisers it plans to bring advertisements to Gemini in 2026. The company maintains that Gemini itself would remain ad-free, despite multiple reports suggesting otherwise.

Translation: Everyone is moving toward the same monetization model, regardless of what they say publicly.

OpenAI cannot afford to cede this entire market to Google. MediaLink research from October 2025 revealed that 84% of marketers observe consumer behavior shifts away from traditional search toward AI-powered answer engines. 45% plan to moderately or significantly shift brand budgets within 12 months.

The advertising dollars are moving to AI platforms whether OpenAI participates or not.

Staying out of that market isn’t principled. It’s financial malpractice.

How User Trust Changes at the Moment of Commercial Intent

OpenAI’s advertising approach represents what analysts call “intent-based monetization.” Ads appear at the bottom of answers in ChatGPT when there’s a relevant sponsored product or service based on your current conversation.

The company positions these ads as “an extension of the thought process” rather than an interruption.

That framing matters because it reveals the ethical complexity at play. Unlike traditional Google search ads that interrupt the browsing experience, ChatGPT ads integrate into the conversation itself.

You ask ChatGPT for advice. It gives you an answer. Then it suggests a product that “aligns” with that advice.

Is that helpful recommendation or commercial manipulation?

The line blurs when the AI appears to be your advisor but operates under advertising incentives. You trust the platform to give you objective information. The platform needs to monetize that trust to survive.

This tension will define the next phase of AI development.

What Happens When Every AI Platform Converges on the Same Model

If OpenAI implements ads, Anthropic will face pressure to follow. If Google monetizes Gemini through advertising, Microsoft will need to respond with similar moves in Copilot.

The competitive dynamics push everyone toward the same monetization playbook.

Here’s what that convergence means for you:

The “ad-free AI experience” becomes a premium tier, not a standard offering. You’ll pay extra to avoid commercialization, just like you do with Spotify, YouTube, and every other platform that started free and shifted to freemium.

Conversational AI becomes commoditized. When every major platform runs on the same hybrid model (subscriptions + ads), the differentiation shifts from business model to performance. The AI that delivers better answers wins, regardless of how it’s monetized.

User expectations reset. The backlash against ads in ChatGPT will fade as advertising becomes normalized across all AI platforms. What feels like a betrayal today becomes standard practice tomorrow.

Data collection intensifies. Advertising effectiveness depends on targeting precision. AI platforms will need to collect and analyze more user data to deliver relevant ads. Privacy concerns will escalate, but so will the financial incentive to gather behavioral insights.

The Broader Industry Trend You Need to Watch

OpenAI’s shift signals a maturation point for the AI industry. The experimental phase is over. The sustainability phase has begun.

Companies that raised billions on the promise of transforming how humans interact with technology now face the reality of paying for that transformation. The infrastructure costs are real. The revenue models need to match those costs.

Subscription revenue alone can’t democratize advanced AI technology when the underlying economics don’t work. You either charge users enough to cover costs (which prices out most people) or you introduce alternative revenue streams (which means advertising).

The idealism that positioned AI as somehow above traditional monetization methods is colliding with spreadsheets that don’t balance.

Financial pressures are overriding user experience considerations.

That’s not a criticism. It’s an observation about how markets work when infrastructure costs outpace revenue growth by orders of magnitude.

What This Means for How You Use AI Tools

You should expect advertising to become standard across AI platforms within 18-24 months. The companies resisting it today will adopt it tomorrow when their financial situations demand it.

Plan accordingly:

Evaluate AI tools based on performance, not purity. The platform with the cleanest business model might not be the one that gives you the best answers. Focus on what works.

Understand the trade-offs. Free AI access means advertising. Ad-free AI means premium pricing. There’s no magic third option where you get advanced technology for free without commercialization.

Watch how platforms handle the integration. The companies that implement advertising thoughtfully (relevant, non-intrusive, clearly labeled) will maintain user trust. The ones that prioritize revenue over experience will face backlash.

Recognize that your data becomes more valuable. AI platforms need behavioral insights to deliver targeted ads. Your conversation history, preferences, and usage patterns become monetizable assets. Decide what you’re comfortable sharing.

The Question Nobody Wants to Answer

Can AI companies build transformative technology while maintaining the infrastructure required to deliver it at scale without resorting to advertising?

OpenAI’s answer is no. The math doesn’t work.

Google’s answer appears to be no. The competitive pressure demands revenue diversification.

The industry’s answer will likely be no. Infrastructure costs keep rising faster than subscription revenue can scale.

This doesn’t mean AI technology will stagnate. It means the business models supporting that technology will look increasingly similar to the platforms that came before them.

The AI revolution continues. The monetization revolution looks a lot like every other platform you already use.

That’s not the future anyone promised. But it’s the future the economics are building.

Leave a comment